Protecting Your Haven: A Guide to Home Insurance

Owning a home is a dream for many, and it’s a symbol of security and sanctuary. However, unforeseen events can sometimes shatter that sense of stability. Natural disasters, accidents, or theft can jeopardize your haven and leave you feeling vulnerable. That’s where home insurance comes in – a safeguard that offers protection, peace of mind, and financial support during times of distress.

In this comprehensive guide, we will explore the world of home insurance and provide you with valuable insights on how to secure and safeguard your most valuable asset. Whether you are a new homeowner seeking to understand the basics or a seasoned homeowner looking for ways to enhance your coverage, this guide will equip you with the knowledge and tools necessary to make informed decisions about your home insurance policy. So, let’s dive in and ensure your haven remains well-protected.

Understanding Home Insurance Coverage

Owning a home is a significant investment that offers security and comfort to you and your loved ones. However, unforeseen events such as natural disasters, theft, or accidents can pose a threat to your haven. This is where home insurance comes into play, providing you with financial protection against such occurrences.

Home insurance is a type of insurance policy that safeguards your home and its contents. It offers coverage for damages caused by fire, lightning, windstorms, hail, theft, and vandalism, among others. In addition to protecting your physical dwelling, home insurance also extends coverage to your personal belongings within the premises.

Understanding the coverage provided by a home insurance policy is essential to ensure that you have adequate protection. It typically includes dwelling coverage, which takes care of repairs or rebuilding costs in the event of structural damage. Personal property coverage offers reimbursement for the loss or damage to your possessions, including furniture, appliances, and clothing.

Moreover, home insurance often includes liability coverage, which protects you in case someone is injured on your property and files a lawsuit against you. This coverage can help with legal fees and any potential damages that you might be required to pay. Hence, having liability coverage is crucial for peace of mind and ensuring that unforeseen accidents do not lead to financial distress.

In conclusion, home insurance serves as a vital safeguard for your haven by providing coverage for various risks and events. From protecting your physical dwelling to covering personal belongings, and even offering liability protection, having adequate home insurance can offer the peace of mind you deserve.

Important Factors to Consider

When it comes to protecting your haven, home insurance is an essential investment. However, selecting the right policy can be a daunting task with so many factors to consider. To ensure you make an informed decision, keep the following aspects in mind:

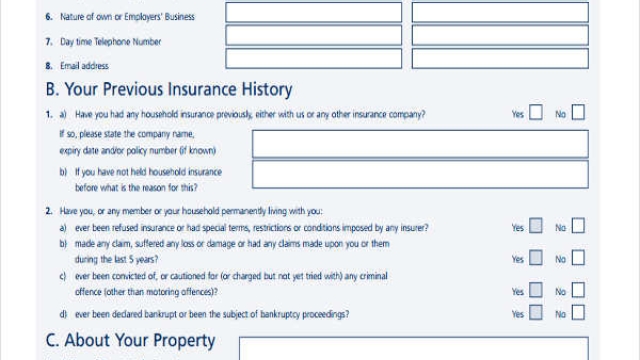

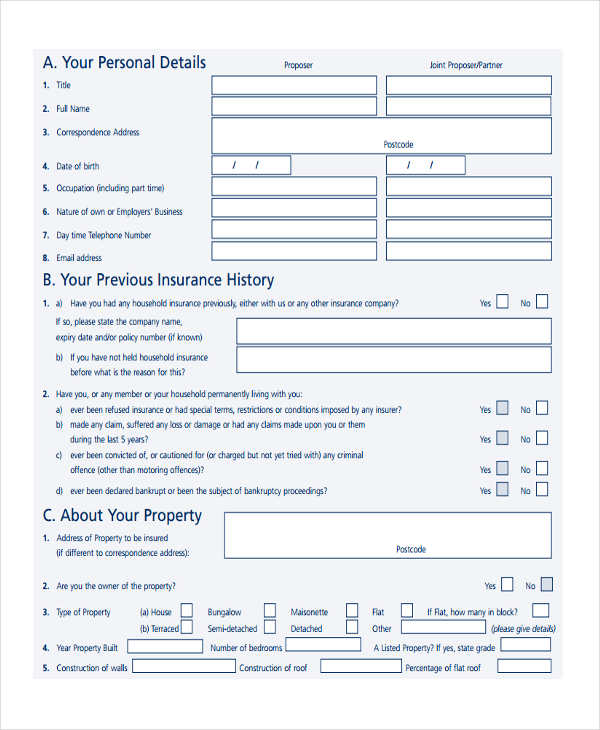

Coverage Options: One of the key factors to consider is the range of coverage options offered by the insurance provider. Home insurance policies often include coverage for the structure of your home, personal belongings, and liability protection. It’s crucial to assess the extent of coverage provided for each area to ensure your policy adequately safeguards your property and valuables.

Deductibles and Premiums: Another important factor is the deductibles and premiums associated with the home insurance policy. The deductible is the amount you must pay out of pocket before the insurance coverage kicks in, while premiums are the periodic payments you make for maintaining the policy. It’s essential to evaluate these costs and strike a balance between a reasonable deductible and affordable premiums that fit your budget.

Claim Process and Customer Service: When the need arises to file a claim, a smooth and efficient process becomes crucial. Before finalizing your home insurance policy, consider the insurer’s reputation for handling claims and their customer service track record. Look for a company with a reputation for prompt and fair claim settlements, as well as responsive and helpful customer support.

By carefully considering these important factors, you can select a home insurance policy that offers the right coverage options, manageable deductibles and premiums, and a hassle-free claims experience. Protecting your haven becomes much easier when you have the right insurance on your side.

Tips for Choosing the Right Home Insurance Policy

- Assess Your Coverage Needs

workers comp insurance Michigan

First and foremost, it is essential to carefully evaluate your home insurance needs. Take into account the value of your property, your personal belongings, and any additional structures on your premises. Consider factors like location, local risks and hazards, and the potential cost of rebuilding or repairing your home in the event of a disaster. Understanding your coverage needs will help you make an informed decision when choosing a home insurance policy.

- Compare Insurance Providers

It’s important to shop around and compare different insurance providers before making a final decision. Take the time to research reputable companies that offer home insurance policies. Look for insurance providers with a reliable track record, excellent customer service, and competitive rates. Gather quotes from multiple companies, taking into consideration the coverage offered, deductibles, and any additional features or riders available.

- Understand the Fine Print

When selecting a home insurance policy, be sure to carefully read and understand the policy documents. Pay attention to the terms and conditions, including coverage limits, exclusions, and any additional requirements or responsibilities placed on the policyholder. Understanding the fine print will enable you to make an informed decision and avoid any surprises or misunderstandings in the future.

Remember, choosing the right home insurance policy is crucial for protecting your haven. By assessing your coverage needs, comparing providers, and understanding the details of your policy, you can make a confident choice that safeguards your home and belongings.