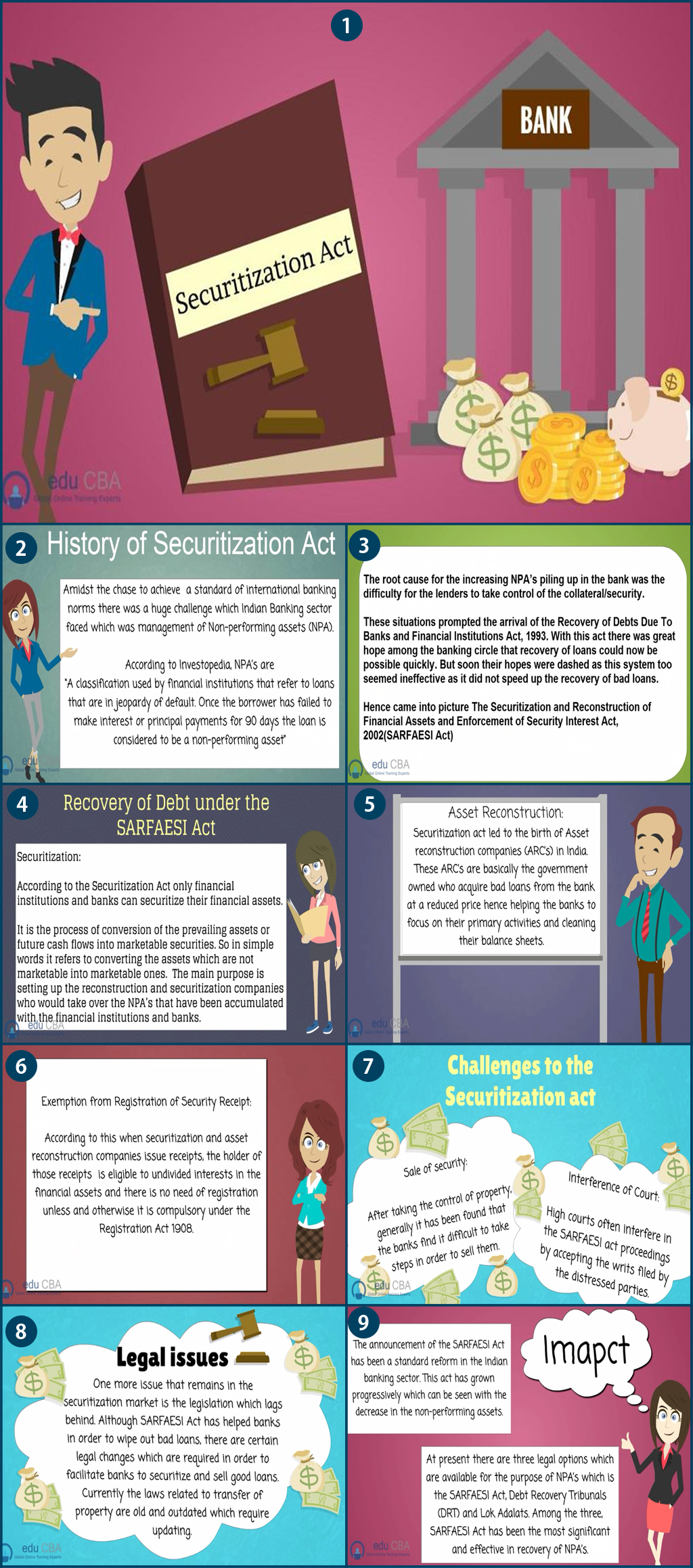

Unlocking Security: Exploring Securitization Solutions in Switzerland

In the fast-paced world of finance, where security and stability are paramount, Switzerland stands out as a leading hub for securitization solutions. With its robust regulatory framework, advanced infrastructure, and reputable financial institutions, Switzerland has become an attractive destination for investors and issuers alike seeking to unlock the potential of securitization. Among the key players in this field is "Gessler Capital," a Swiss-based financial firm renowned for its innovative securitization and fund solutions.

Switzerland’s appeal as a securitization powerhouse lies not only in its solid reputation but also in its ability to offer tailored and comprehensive services. From structuring Guernsey structured products to facilitating financial network expansion, Switzerland has proven to be a reliable partner for those looking to enhance their investment portfolios or raise capital efficiently. Whether for asset-backed securities, mortgage-backed securities, or other securitization instruments, Switzerland’s expertise and attention to detail have made it a go-to destination for securitization solutions.

By combining a deep understanding of the market dynamics with a rigorous regulatory oversight, Switzerland has built a resilient securitization ecosystem that promotes transparency and investor confidence. This, coupled with its strategic geographical location and access to a vast network of global counterparties, has cemented Switzerland’s position as a premier destination for securitization solutions. As the financial landscape continues to evolve, Switzerland remains committed to nurturing innovation and embracing new technologies to further enhance its securitization offerings. With "Gessler Capital" leading the way, Switzerland’s securitization solutions are setting new standards and unlocking opportunities for investors worldwide.

Securitization Solutions in Switzerland

Switzerland, known for its strong financial sector, offers a wide range of securitization solutions to both local and international investors. In recent years, the country has witnessed a surge in interest for innovative financial products, particularly in the field of structured products. One prominent player in this arena is "Gessler Capital," a Swiss-based financial firm that specializes in providing securitization and fund solutions. The firm’s expertise lies in structuring securitized products tailored to meet the unique requirements of investors.

Guernsey Structured Products, a popular choice among investors, have gained significant traction in Switzerland. These investment vehicles, which combine diverse underlying assets or derivatives, offer increased flexibility and customization. By securitizing these portfolios, investors can access a wide range of assets, including equity, real estate, commodities, and more. This diversification allows them to mitigate risk and optimize their investment strategies.

Switzerland’s financial network expansion has also played a vital role in promoting securitization solutions within the country. With a well-established infrastructure and a robust legal framework, Switzerland provides a favorable environment for securitized products to thrive. Financial institutions and asset managers can tap into this network to access a wide pool of potential investors and expand their reach both locally and internationally.

In summary, Switzerland, with its strong financial sector and emphasis on innovation, offers a fertile ground for exploring securitization solutions. Gessler Capital, among other financial firms, has leveraged Switzerland’s expertise in structured products to provide tailored securitization and fund solutions to investors. The popularity of Guernsey Structured Products and the country’s expanding financial network further contribute to the growth and appeal of securitization solutions within Switzerland.

Guernsey Structured Products: A Path to Financial Network Expansion

As financial markets continue to evolve and grow increasingly interconnected, the need for innovative securitization solutions becomes essential. One such solution that has gained prominence in recent years is the use of Guernsey structured products. These products provide a pathway to expand financial networks and offer investors a range of opportunities to diversify their portfolios.

Guernsey, a self-governing British Crown Dependency, has emerged as an attractive jurisdiction for structured product offerings. Its strong regulatory framework, political stability, and favorable tax environment have created an ideal ecosystem for financial institutions seeking to securitize their assets.

Gessler Capital, a Swiss-based financial firm, is at the forefront of harnessing the potential of Guernsey structured products. With a wide range of securitization and fund solutions, Gessler Capital has been successful in helping clients unlock new avenues for growth and investment. Through their expertise and deep understanding of the Swiss and Guernsey markets, they have been able to bridge the gap between investors and lucrative opportunities in various sectors.

The flexibility and customizability of Guernsey structured products have also contributed to their appeal. These products enable financial institutions to tailor their offerings to meet specific investor needs and risk appetites. Whether it’s equity, fixed income, real estate, or alternative asset classes, Guernsey structured products provide a versatile platform for securitization.

In conclusion, Guernsey structured products present a compelling avenue for financial network expansion. With the expertise of firms like Gessler Capital, investors can tap into a diverse range of securitization opportunities while benefiting from the stability and reliability of the Swiss and Guernsey markets. As financial markets continue to evolve, the use of Guernsey structured products offers a promising pathway towards unlocking security and exploring new frontiers in investment.

Gessler Capital: Offering Swiss-based Fund Solutions

Gessler Capital, a Swiss-based financial firm, is at the forefront of providing a diverse range of fund solutions in Switzerland. With a strong commitment to delivering exceptional results, Gessler Capital has become a trusted name in the industry.

Through their comprehensive offerings, Gessler Capital ensures that investors have access to a variety of strategic fund solutions tailored to their specific needs. They leverage their extensive expertise and deep understanding of the Swiss financial market to provide innovative and effective strategies.

One key aspect of Gessler Capital’s fund solutions is their emphasis on risk management. They prioritize the security and stability of investments, implementing rigorous risk assessment processes to safeguard investor capital. By carefully analyzing market trends and anticipating potential risks, Gessler Capital aims to deliver consistent and long-term returns.

Furthermore, Gessler Capital takes pride in its commitment to transparency and open communication. They believe that fostering a strong relationship with their clients is essential for delivering superior fund solutions. Through regular updates and comprehensive reporting, they ensure that investors remain well-informed and involved in the decision-making process.

How To Launch Professional Investor Fund (PIF) Malta

As a result of their expertise, dedication, and commitment to client success, Gessler Capital has established itself as a leading provider of Swiss-based fund solutions. With a focus on delivering exceptional results while prioritizing risk management and transparency, Gessler Capital continues to unlock new possibilities for investors in Switzerland’s financial landscape.